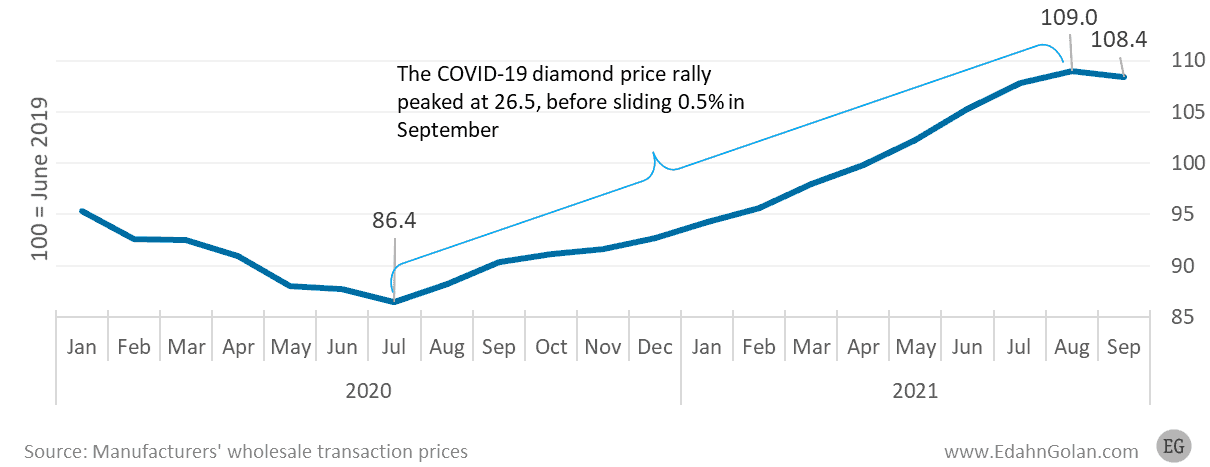

The figures are unambiguous and they are positive. The economy slowdown due to the health crisis has given way to a visible recovery in the diamond industry. What’s driving this is the robust rebound in retail trade, notably in the United States where jewelry sales were up 83% in last July (Mastercard SpendingPulse data, but the jump is compared to the lockdown period). Hong Kong, deprived of luxury tourism related retail, is banking on the burgeoning retail jewelry chains now widely branched out into mainland China. The feeling is that Las Vegas has triggered enthusiasm among dealers, as has the September show in Vicenza, reflecting a widespread demand throughout the old continent.

Prices have shown positive growth since January 2021 and steady increases each month thereafter. The last peak, in July 2018, had been 5.7%. This had been followed by nine months of slowdown and 18 months of negative trends due to the pandemic. Big miners reintroduce raw material, Alrosa sold US$334 million of rough in July alone.

It isn’t all puppy dogs and rainbows though. Well, let’s give the necessary room to excitement. Yet, when taking a closer look at the last five years’ data, it seems evident that the new course of prices and consumer demand for diamonds does not correspond to an identical bullish outlook for jewelry which on the contrary in the United States is performing below expectations. The post-crisis euphoria will inevitably come to a halt, highlighting the fact that overseas it is largely fueled by consumer debt. The credit supply to the distributive sector has shrunk, especially in India. Mining costs will be more and more expensive while the ghost of synthetic diamonds has been casting shadows over the business environment for years.

Some influential and reputed commentator even predict a diamond bubble that could potentially result in a price crash. This assumption is based on the fact that inventories have been filled too quickly and that the purchasing frenzy will collapse when the free-all hangover passes. Just as we didn’t let COVID-19 get us down, we won’t make predictions so brazenly optimistic as to challenge common sense. Right now, though, everyone in your seats. Let’s get to work.

By Sergio Sorrentino, published on IGR – Italian Gemological Review #13, Autumn 2021